Debt Collection Litigation

Debt Collection Litigation and Judgment Collection

While our preference is to resolve debt collection matters outside of court, achieving this in over 97% of successful claims, we are prepared to initiate legal action when necessary. When court proceedings become the only viable or acceptable option, we do not hesitate to file lawsuits, a course of action we pursue regularly.

In-House Attorney

When necessary, we initiate a comprehensive out-of-court debt collection effort under the banner of our in-house law firm, all at the same low contingency rates. There are no upfront costs associated with this effort, and our contingency rates remain unchanged. Our in-house legal team steps in when progress is insufficient under the collection agency’s name. Often, simply informing the debtor that their case will be referred to our attorneys if a resolution isn’t reached is enough to spur action. Some individuals only take matters seriously once contacted by legal representation. In both scenarios, our clients benefit from seamless escalation without increased costs.

Unlike agencies without an in-house legal arm, we have no reservations about involving attorneys, as our financial incentives remain consistent. Although our in-house law firm does not initiate lawsuits, we have established a nationwide network of specialized collection attorneys who handle litigation and judgment collection. These attorneys manage cases throughout the legal process, and we resolve over 97% of successful cases without resorting to court action. We never litigate without obtaining written permission from our clients.

Collection Litigation

We’ve established a nationwide network of debt collection attorneys across the United States who operate on a contingency basis. This network is essential because lawsuits must typically be filed in the debtor’s jurisdiction. By leveraging this network of attorneys willing to work on a contingency basis, we provide our clients with a significant advantage when litigation becomes necessary. While our clients benefit from low costs, debtors are often compelled to resolve the matter swiftly, as they’ll be responsible for paying their attorneys on an hourly basis. This dynamic frequently applies pressure on debtors to settle or allows us to obtain a default judgment, leading to the judgment collection phase.

We adhere strictly to our policy of never initiating litigation without explicit written instructions from the client. Prior to proceeding to court, we provide a firm quote tailored to the specifics of the individual claim.

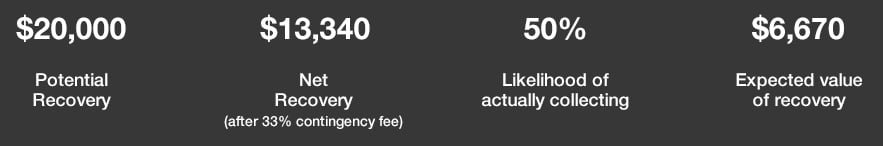

In our assessment of whether to pursue litigation, we prioritize Return on Investment as the key consideration. Our evaluation involves a thorough analysis of the potential costs associated with litigation, as detailed in our video and transcript on debt collection litigation. We also assess the probability of successfully collecting the debt. By comparing these factors with the available alternatives, we enable our clients to make informed decisions regarding the potential return on investment for debt collection litigation. To simplify this analysis, we employ a straightforward equation, as illustrated in the example below:

Before offering recommendations, we meticulously assess each of these variables and provide our clients with a comprehensive analysis to support our advice. Evaluating the probability of successful debt collection is particularly challenging, requiring consideration of numerous factors. To facilitate understanding, we have condensed many of these factors into an easily digestible debt collection litigation graphic, which has been featured in industry newsletters.

Throughout the litigation process, we oversee the management of debt collection attorneys on behalf of our clients, offering guidance and recommendations at every stage.

Collection Litigation

Securing a favorable judgment in court, a feat we achieve 99.9% of the time, marks just the initial phase of our process. Following this, we embark on the judgment collection process, a detailed explanation of which can be found in our video and transcript.

We take charge of managing the debt collection attorneys and overseeing the judgment collection process on behalf of our clients. Utilizing our extensive experience, we ensure that all necessary steps are executed promptly and within the prescribed time frames. Furthermore, we explore all available alternatives and offer recommendations on the most suitable course of action. In cases where litigation is deemed necessary, our in-house attorney collaborates closely with our network of collection attorneys, tailoring strategies to suit the unique circumstances of each case.

It’s important to note that we do not handle claims where a judgment has already been obtained. Our judgment collection services are exclusively offered for claims where we initially provided debt collection services and mutually agreed with the client that litigation was the appropriate course of action based on the outcomes of the collection process. However, if you already possess a judgment and require assistance, we offer a referral system on our website. Simply fill out the form, indicating that you already have a judgment, and we will provide you with the contact details of other agencies that may be able to assist you.